SoftBank Corp.

at a Glance

Our Group

- [Notes]

-

- *1

As of March 31, 2025, the Group holds shares of PayPay Corporation (“PayPay”) via B Holdings Corporation (“BHD”, a holding company jointly managed by the Company and LY Corporation (“LY”), a subsidiary of the Company. The Company and LY each hold 50% of BHD. BHD holds 57.9% of PayPay's voting rights. In addition, the Company and LY each hold 5.9% of PayPay's shares directly. Through this capital structure, the Group holds 69.8% of PayPay's voting rights (45.8% of economic interest). The shareholding ratio mentioned above is before SVF II Piranha(DE) LLC (“SVF2”) exercises its stock acquisition rights, which were issued to Paytm at the end of September 2020 and transferred to SVF2 in December 2024.

- *2

The Company holds LY via A Holdings Corporation (“AHD”), a consolidated subsidiary of the Company (the Company and NAVER Corporation each hold 50% of the voting rights), and AHD holds 62.5% of the voting rights in LY as of March 31, 2025.

- *3

As of March 31, 2024

- *4

As of May 20, 2024

- *

The structure shows a part of our subsidiaries and affiliates. For all group companies, see SoftBank Corp. Companies.

- *

% indicates percentage of the shareholding ratio as of March 31, 2025 unless otherwise specified.

- *1

Business Fields

Sustainable Growth

- [Notes]

-

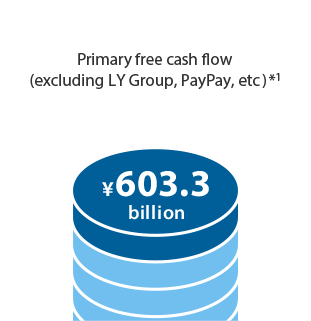

- *1

Primary free cash flow is a measure calculated by adding back the amounts spent as long-term growth investments to adjusted free cash flow (excluding LY Group, PayPay, etc.). Adjusted free cash flow (excluding LY Group, PayPay, etc.) = free cash flow + (proceeds from the securitization of installment sales receivables - repayments thereof) - free cash flow of LY Group, PayPay, etc. + other items such as dividends received from A Holdings Corporation and investment in PayPay Securities Corporation. “LY Group, PayPay, etc.” refers to AHD, LY and its subsidiaries (LY Group), BHD, PayPay, PayPay Card Corporation, PayPay Securities Corporation, etc. Long-term growth investments include investments in AI computing infrastructure and AI data centers.

- *2

The Company conducted a stock split whereby each share of the Company's common shares was split into 10 shares, with the effective date being October 1, 2024. “Earnings per share” and “Dividend per common share” are calculated assuming that the stock split had been carried out at the beginning of the previous fiscal year.

- *3

The dividends related to Bond-Type Class Shares are deducted in the calculation of “Earnings per share.”

- *

Above figures are as of FY2024, on a consolidated basis (except primary free cash flow).

- *1

Services and Brands

Services for enterprise customers

- [Note]

-

- *Percentage of listed companies with revenue of ¥100 billion or more that have transactions with the Company.

- *

Media services

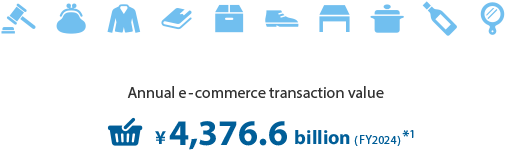

E-Commerce services

Mobile payment and FinTech services

Mobile services

Broadband services

- [Notes]

-

- *1Total transaction volume of domestic merchandise, services, digital content, and overseas e-commerce.

- *2Number of subscribers or user IDs rounded to nearest 0.01 million

- *1

New businesses

The Company expands new businesses through collaboration with various partners

-

Consultation regarding introduction and operation of the autonomous vehicle, development and operation of autonomous driving technology related to passenger and logistics businesses

A joint venture with Toyota and other partners to promote next generation mobility services and to create value from solving social issues related to mobility

Providing solutions for software-defined connected vehicles

-

Endpoint security solutions to protect enterprises from cyber attacks

Real-time, on-device protection against known and unknown threats with a proprietary machine learning technology

-

Platformer based on big data analysis utilizing energy data and Home IoT to enrich the daily life of people

Sales and purchases of power and mediating power transaction

-

Location-based big data business

Data business solutions / Digital marketing

AI-based image recognition

Developing Japanese-based Large Language Models (LLM)

-

Network equipment R&D, construction for HAPS business and planning for spectrum usage, innovative solutions for connectivity

HAPS: high altitude platform station -

Online healthcare services

-

Building the trusted Cross-Carrier Blockchain Networks with global telecommunication carrier partners

-

Generates and delivers correctional positioning information of centimeter-level accuracy

Community centric workspace and space-as-a-service platform

Solving hotel and traditional accommodation issues

using IT

Taxi-hailing platform leveraging AI technology

Supporting the realization of smart building construction (including integration with building operating systems)

Corporate Data

- [Note]

-

- *Total of consolidated subsidiaries, equity method affiliates, and other affiliates, etc.

- *

Related contents

Growth Strategy

Our growth strategy “Beyond Carrier”

Events and Presentations

Online presentation and materials on Earnings Results Briefing, Investor Meeting, etc.

Integrated Reports

Latest and past Integrated Reports